Home Development Mutual Fund (HDMF), popularly known as Pag-IBIG (Pagtutulungan sa kinabukasan: Ikaw, Bangko, Industriya at Gobyerno) Fund assured to its member the refund of member’s total accumulated savings (TAV), which consists of the member’s monthly savings, employer counterpart share (if any) and total annual dividend earnings. But wait, don’t be too much excited because there are certain criteria or grounds for withdrawals. In this article, I will tackle the applicable rules as well as the Requirements for Claim.

Here are the 6 Grounds for Membership Termination or Withdrawal

1. Membership Maturity

Member must have remitted at least 240 monthly membership contributions with the Fund. For Pag-IBIG Overseas Program (POP) members, membership with the Fund shall be at the end of five (5), ten (10), fifteen (15), or twenty (20) years depending on the option of the member upon membership registration.

Read Also: Step-by-Step Guide on How to Apply for a Pag-IBIG Housing Loan

2. Retirement

member shall be compulsorily retired upon reaching age 65. He may however, opt to retire upon the occurrence of any of the following:

- Actual retirement from the SSS, the GSIS or a separate employer provident/retirement plan, provided the member has at least reached age 45

- Upon reaching age 60

3. Permanent Total Disability or Insanity

The following disabilities shall be deemed total and permanent:

- Temporary total disability lasting continuously for more than 120 days;

- Complete loss of sight of both eyes;

- Loss of two limbs at or over the ankle or wrist;

- Permanent complete paralysis of two limbs;

- Brain injury resulting in incurable imbecility or insanity; and

- Such other cases which are adjudged to be total and permanent disability by a duly licensed physician and approved by the Board of Trustees.

4. Termination from Service by Reason of Health

5. Permanent departure from the country

6. Death

In case of death, the Fund benefits shall be divided among the member’s legal heirs in accordance with the New Civil Code as amended by the New Family Code.

Requirements for Claim

Basic Requirements apply to all reason for claim

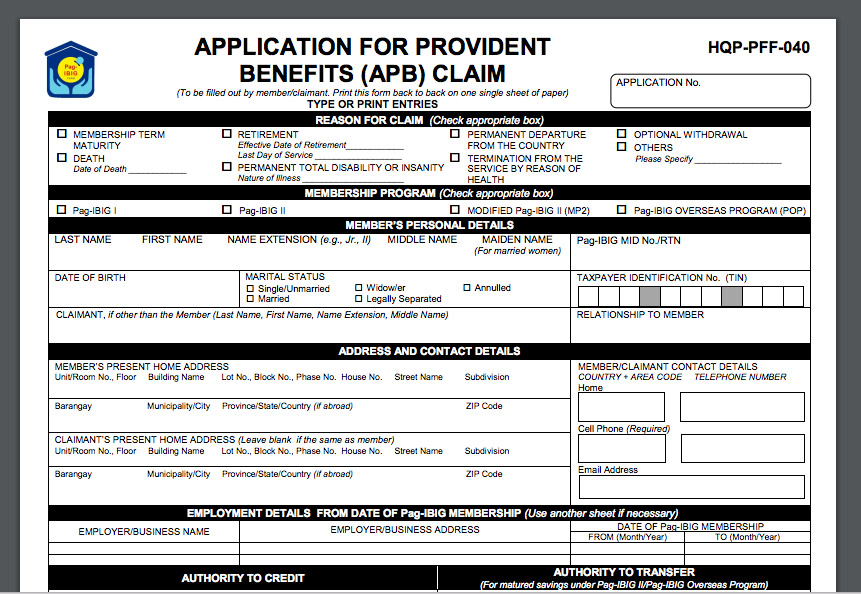

1. Application for Provident Benefits Claim (APB, HQP-PFF-040)

2. Pag-IBIG Transaction Card and one (1) valid ID card with photo and signature of Claimant

Notes :

- If the Pag-IBIG Transaction Card is not available, two (2) valid ID cards with photo and signature of Claimant.

- Pag-IBIG Transaction Card and one (1) valid ID card with photo and signature of Claimant.

3. Service Record (For Government Employee)

4. Statement of Service (For AFP)

Additional Requirements

(The following additional documents shall be submitted depending on the reason for claim)

A. For Death

1. NSO/PSA Certified True Copy of Member’s Death Certificate

2. Notarized Proof of Surviving Legal Heirs (HQP-PFF-030)

3. NSO/PSA Certified True Copy of Birth Certificate of all children or Baptismal/Confirmation Certificate (If with child/children)

4. Notarized Affidavit of Guardianship (HQP-PFF-028) (if with child/children below 18 years old, or if child/children is/are physically/mentally incompetent)

5. To establish kinship with the deceased member, the claimant shall submit any one of the following:

- NSO/PSA Certified True Copy of Member’s/Claimant’s Birth Certificate

- NSO/PSA Certified True Copy of Non-Availability of Birth Record and Notarized Joint Affidavit of Two (2) Disinterested Persons (HQP-PFF-029)

- Certified True Copy of Member’s/Claimant’s Baptismal/Confirmation Certificate

- If Member is single, Certificate of No Marriage (CENOMAR)

- If Member is married, NSO Certified True Copy of Member’s Marriage Contract and Advisory on Marriage.

B. For Retirement

1. Any one of the following:

- NSO/PSA Certified True Copy of Birth Certificate

- NSO/PSA Certified True Copy of Non-Availability of Birth Record and Notarized Joint Affidavit of Two (2) Disinterested Persons (HQP-PFF-029)

2. Notarized Certificate of Early Retirement (For Private Employee only, at least 45 years old)

3. GSIS Retirement Voucher (For Government Employee)

4. Order of Retirement (For AFP)

C. For Permanent Total Disability or Insanity/Termination from the Service by Reason of Health

- Physician’s Certificate/Statement (With clinical or medical abstract)

D. For Permanent Departure from the Country

- Photocopy of Passport with Immigrant Visa/Residence Visa/Settlement Visa or its equivalent

- Notarized Sworn Declaration of Intention to Depart from the Philippines Permanently (HQP-PFF-031) (No need to submit if already based abroad)

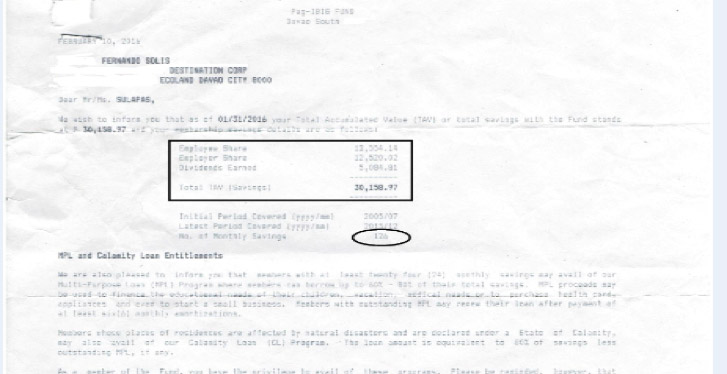

For the procedure, I will illustrate with you guys the very common ground for withdrawals, the Membership Maturity, based on the experienced of my husband, he is an employee for 12 years now, his initial period covered to Pag-IBIG Fund was July 2005. February 2016, he received a copy of his Total Accumulated Value (TAV) or total savings with Pag-IBIG Fund from his employer. He completed 10 years or 120 months’ contribution without gap to Pag-IBIG Fund without existing loan.

Read: How to Check Your PAG-IBIG Monthly Contribution and Loan Payment History

Good thing every year Pag-IBIG Fund Davao released a copy of member’s Total Accumulated Value (TAV) through a company liaison for members to know their total savings with Pag-IBIG Fund. Based on my husband (TAV) shown below, he is qualified for the Maturity grounds for Membership Withdrawal.

Well for steps, it was just quite simple, he visits Pag-IBIG Fund Office-Davao South Branch, then asks the guard where he can inquire about Pag-IBIG Fund withdrawal. The guard directly pointed window 1 to inquire, he asked by the Pag-IBIG staff for his concern, then the staff ask him a valid ID, my husband presented his company ID, after few minutes he was transferred to window 2 for verification if he had unpaid Housing Loan or Short Term Loan.

After verification he was again endorsed to window 1, that time he was given Application for Provident Benefits Claim (APB, HQP-PFF-040) to filled-up, the staff processed the request then he was given a claim stub indicating the date for his check when to pick-up. According to him, he was just consumed 30 minutes all in all in processing his Pag-IBIG Fund withdrawal.

That’s it. If you aren’t sure of your Total Accumulated Value (TAV) you can always ask for print out, just visit nearest Pag-IBIG Fund office in your place or you can email them at [email protected] or call them 724-4244 (Pag-IBIG) – 24/7 Call Center operation.

Read Also:

- How to get Pag-IBIG Loyalty Card

- Pag-IBIG Online Registration Walkthrough

- Eligibility Requirements for Pag-IBIG Housing Loan

IMPORTANT

- Pag-IBIG FUND RESERVES THE RIGHT TO REQUEST ADDITIONAL DOCUMENTS, IF DEEMED NECESSARY. PROCESSING OF CLAIMS SHALL COMMENCE ONLY UPON SUBMISSION OF COMPLETE DOCUMENTS.

- IN ALL INSTANCES WHEREIN PHOTOCOPIES ARE SUBMITTED, THE ORIGINAL DOCUMENT MUST BE PRESENTED FOR AUTHENTICATION.

- IF MEMBER/CLAIMANT CANNOT CLAIM PERSONALLY, SUBMIT SPECIAL POWER OF ATTORNEY (HQP-PFF-033) AND TWO (2) VALID ID CARDS EACH OF THE PRINCIPAL AND ATTORNEY-IN-FACT.

Source: Pag-IBIG Fund

Pwd po ba makuha ang maturity kahit putol2x ang hulog pero nka 120mons naman po?

How to claim the 10years pag-ibig backpay

pwede po ba makuha maturity kahit may loan paano po ba nalalaman kung qualified ka

makakuha pa ba ako na 6-years lang ako naghulog noon nasa Pinas lang ako? di ba pasado kung ganun? paano naman ang nadiduct sakin ng Company ko dati ang mangyayari ba nyan’ forget na ba?

Ask ko lang po regarding sa contribution ko nakapag hulog po ako ng 17years now two years na ko wala work pwedi po kaya ako maka claim for early reterment..

Paano ko po kya malalaman,kung may naihulog ang Mister ko sa Pag-ibig,dati po syang natrabaho sa Mattel Philippines taong year 1984 or 1985 nagstart,tapos nagsara po ang Mattel Philippines napalipat nmn po sya ng The Medical City,Genersl Hospital inabot po sya ng halos sampung taong nagtrabaho sa Ospital bukod pa po ang sa Mattel,namatay na po ksi Mr.ko dapat po ay aayusin nya lahat para maka pag update,kso hindi na po nangyari khit id po nya ay wala po sya at di rin nmin alm ung Pag ibig no.nya…bka po matutulungan nyo ako…name po nya ay ROBERTO CAPILI CRUZ

Gd pm. Tanong ko lang, ano gagawin naming kinaltasan ang sahod nang husband ko para sa pg ibig fund mga 2 taon, pero doon sa Mindanao ni remit tapos taga Bohol kami. Ano gagawin namin matagal na yun Hindi man lang binigay yong I d nang husband ko. Pwede ba makuha naming yun?

pwede ba maka avail may loan ako date pa noong 2011 nde ko nabayaran

Papano po pwedwng mawidrw ang pag ibig Al most 10year’s na po a no akong nag huhulog

Nag awol po ako sa work ko, at that time, labis na binayad ko sa loan ko sa pag-ibig, Bakit ang overpayment sa loan ko, hindi nila ibigay.labis na bayad po yun..sabi nila irerelease sakin pag 60 years old na ako, 44 pa lang ako, hintayin ko pa ba ang 16 years para makuha ang pera ko?

Hello Bleselda ang pwd na ma withdraw kung kayo ay di pa 60 yrs old ay yung tuloy-tuloy na hulog sa loob ng 10 yrs or may 120 months’ contribution at walang unpaid loan balance.

at kung kayo nmn ang 60 yrs old pataas mandatory nmn ibibigay sa inyo lahat ng naipong contributions regardless kung ilang months lng nahulugan.

Panu at san po makakakuha ng voucher. Puede po ba malaman thru online kung my existing loan pa kung nabayaran ng company anu po kelangan gawin

may housing loan po ako. pwede po kayang e-offset yong contribution ko? then kung hindi enough yong total contribution ko bayaran ko ng cash.

tanong ko lng po..

pde parin po b makuha o mwithdraw yung pag-ibig contribution ng mother ko khit 10yrs npo siyang nmayapa?

Ako din po, paano po malalaman kung naclaim na po ung pagibig ng motber-in-law ko. Nabangit po kc sa amin ng kamaganak ng mother-in-law. Deceased na po sya at mahigit ng 20 yrars na syang pumanaw. Machechrck pa po ba un. She was a former public school teacher for almost 20 years din po.

62 na po ako ngayon at nagmature na rin yung PAGIBIG membership ko ..23 years na po ako sa serbisyo bilang public school teacher ..kumuha ako noon ng housing loan pero na foreclosed dahil hindi ko nabayaran may certificate po ako ng foreclosure…ang tanong may makukuha pa ba ako sa Pagibig? Paano ko makukuha kung meron? Hanggang ngayon nagtatrabaho pa rin ako at sasagarin ko na hanggang 65 years old po..ano ano po ang mga kailangang papel ? Maraming salamat po sa sagot ninyo..

My dad passed away some 25 years ago.. Can my mother claim his contribution? If yes, how and what are the requirements. Thank you.

You can inquire directly to Pag-IBIG Fund office if it is possible to claim your father contribution.

In case of death, the Fund benefits shall be divided among the member’s legal heirs in accordance with the New Civil Code as amended by the New Family Code. Pls read the article for full details

Pwede bng mawidraw ang contribution kht n may existing loan ka? At kung may gap ka ng 1 month pwede p rn kyang mawidraw ang contri?

kailangan po ay tuloy-tuloy na hulog sa loob ng 10 yrs/15 yrs /20 yrs contributions at walang unpaid loan balance saka ma withdraw. visit ka sa Pag-IBIG office para humingi ng copy ng ‘yung member’s Total Accumulated Value (TAV) dun mo malalaman kung qualify kana makapag withdraw.

Pwede ba sa health reason ang pag withdraw yung nakapag resign ka agad kasi bagong panganak ka nun at malayo pa work mo sa laguna at uwian mo taytay.at kapapanganak ko lng ng aug.1997 at nag resign ko dec..at la mag alaga sa anak ok??

Pno po b mkukuha yung kulang sa 10 years ko n contribution ano mga requirements at pno dpt gwin

Tanong ko lng po ksalukuyan pa ako nag tatrabaho pero kailangan ng pera pwede ko ba i withdraw hulog ko na halos 27 years na sa pag ibig na gnun matagal pa ako mg retire dahil 50 yrs old plang ako sa ngayon? Maraming salamat po, more power!

Paaano puba makuha yung pagibig fund kasi nastroke na po ako kasi…dina ako nakawork po

Pls visit po Pag-IBIG office.

pa ano po ma withdraw ang 15years nga contibution?

kailangan po ay tuloy-tuloy na hulog sa loob ng 10 yrs or may 120 months’ contribution at walang unpaid loan balance saka ma withdraw. visit ka sa Pag-IBIG office para humingi ng copy ng ‘yung member’s Total Accumulated Value (TAV) dun mo malalaman kung qualify kana makapag withdraw.

how to widraw pag ibig member

pls read the article po para sa buong detalye.

klangan ko na po ilump sum ang TAVcontributions ko po, 155 months ang naigulog ko po, i started 1997 lasted 2010 of july. no existing loans i been made even once. time i worked with my employer Ricky Reyes company. can i now withdraw my accounts.

bakit backpay tawag mo eh, savings mo yan ahhh.

problemang malaki yan, kahiman di kayo nag uusap about pag ibig fund?

Yung skin po Pwede ko na po ba ilumpsam over over na po Yung contribution ko pero may loan balance pa po ako ano dapatko gawin

Tanong ko lang po may makukuha po ba yung na aksidente kagaya po ng nabali po ang left anckle due to accident…

Paano po mag loan 6years na po ako nag huhulog sa pag ibig pero di pa po ako nakakapag loan.

Gud pm tanung lng po my makukuha po ba ang isang tao almost 30yrs po sya sa goverment 2006 po sya nagresign kasi po senior na po nun time na un

Pano po kung naka short term loan ako tapos masama ako sa nabawas na empleyado.ito po at noong 2011 pa at Hindi ko nabayaran kahit konti ang loan ko.sa ngayon pa extra akong pintor walang mga deduction dahil labor lang.pls reply

Good afternoon po. Ten yrs na po ako in service. wla po ako loan. pwd po b ako mkawithdraw ng contribution ko s pag-ibig. slamat po s tugon n u o.

Pwede po bang iclaim yung pag ibig contribution kahit may housing loan? Salamat po

Good day Ma’am/Sir Ask ko LNG po nag resign na po kasibako pwde po babilansam ung hulog ko sa Pag ibig

Ask ko lng po. Na stop po ang paghulog ng asawa ko last 2015 pa po. Dahil na force to resign at ibinenta ang company sa new management. At hindi na po nahulugan ulit. Pwd parin po ba may makuha ang asawa ko? 8years po sya sa company.

Na terminate na po asawa ko sa work niya almost 2 years po sya naghulog.. Marerefund po ba namin yun

Sir/maam naka 30 years na po ako in the service nakuha ko na po ang 20 years noong 2010.gusto ko po kunin ang 10 years ko na po pwede po ba?. How po?

good morning maam sir, how about the co terminos (politician) 2 or 3 terms lng tapos hindi tumakbo,at wala pang 60 how many years to wait bago namin makuha.thanks

A ko ma’am tuloy2x ang hulog for 17 yrs pero nagsara nna ang company at may unpaid loan ako…4 years ko ng di nahulugan…im 49 years old na …gusto ko sana ma claim yung contribution ko…pwede po ba….paano..

Julieta Valdez po ako nueva ecija 70 yes old na me contributions ako sa pagibig kc nagtrabaho ako until 1985 nung ngawol ako dahil ngpunto ako Saudi nagverify ako sa pagibig at gusto ko marefund lahat contributions ko only that klangan service record pmunta ako sa bureau of energy ung hurling employment ko but nirequire ako mgclearance which means lahat ng dept heads klangan pirma how will I pursue thisbkung d ako makatravel I am senior citizen besides pandemic ngayon I need my refund for my maintenance meds n vitamins wala ako income whatsoever I just depend on help.from relatives kung me ibbgay my children are jobless n my husband who also has contributions sa.pagibig dahil sundalo.cya dati at magsasaka.lamang at iuutàng.naming ang puhunan sa.pagtatanim please help.us secure or refund our money maràming salamat po

ano po ba ang sinasabi nilang certificate.of employment sa SSS? as requirements sa PROVIDENT CLAIM

Paano q po malalaman ang details ng aking contributions sa Pag ibig 1at MP2. Voluntary po aq. Thank you!

Ngresign po ako january 2021 may balance pa akong lian 13 yers po akong nghuhulog mawiwithdraw kopa ung pag ibig contibution k?

I am a pag ibig member.. me loan ako sa pag provident loan pero hindi pa ako bayad sa loan ko..gusto ko sana i withdraw yun contribution ko…i am already 58 years old puede ba ako mag early retirement ?

Am a gov’t employee,is there any any add’l benefit to claim if I retire frm service at the age of 65.

Pano po ang step s pag withdraw?thank u po

Ma’am,kakaloan ko lang po,nahinto ako sa trabaho pwd ko pa rin ba claim if ever kukunin ko lahat ng contribution ko?

Pwede po bang mag apply ng membership maturity withdrwal kahit may existing na housing loan?