The Home Development Mutual Fund (HDMF), more popularly known as the Pag-IBIG Fund, was an answer to the need for a national savings program and affordable shelter financing for the Filipino worker. Best example is the housing loan program grants opportunities to Pag-IBIG Fund members to avail of housing loans to finance every Filipino worker to have a decent shelter.

With the availability of The Home Development Mutual Fund (HDMF) e-services on their official website, anyone can now perform Membership Registration, Employer Registration, OFW Member’s Contribution Verification, Kasambahay Unified Registration, Housing Loan Application, Developer’s Online Housing Loan Application, etc.

Read: Eligibility Requirements for Pag-IBIG Housing Loan

What is a Pag-IBIG Housing Loan?

The Pag-IBIG Housing Loan is a government-backed financing program in the Philippines aimed at helping Pag-IBIG Fund members acquire their own homes. Here’s a summary of its key features and benefits:

Key Features

- Loan Purpose: For purchasing residential properties, constructing homes, home improvements, or refinancing existing loans.

- Loan Amount: Up to ₱6 million, depending on contributions and qualifications.

- Interest Rates: Competitive rates ranging from 5.75% to 9.75% per annum.

- Loan Term: Repayment periods of up to 30 years.

- Flexible Payment Options: Borrowers can choose different payment plans.

Eligibility Requirements

- Active Pag-IBIG member with at least 24 months of contributions.

- At least 18 years old but not older than 65 years old at loan maturity.

- Proof of income and good credit history.

Additional Benefits

- No prepayment penalties.

- Access to various housing programs, including affordable housing options.

How much can I borrow with a Pag-IBIG Housing Loan?

The amount you can borrow with a Pag-IBIG Housing Loan primarily depends on your contributions to the Pag-IBIG Fund, your capacity to repay the loan, and the type of property you are purchasing. Here are the general borrowing limits:

Maximum Loan Amounts

- For Regular Members: The maximum loan amount is ₱6 million.

- For Members with Higher Contributions: Members with higher monthly contributions or those who qualify under specific programs may have access to the same maximum amount.

Factors Influencing Loan Amount

- Contributions: Your total contributions to the Pag-IBIG Fund can affect your loan eligibility and amount.

- Income: Your proof of income and financial capability will be assessed to determine how much you can borrow.

- Property Location: The property’s location and type may also influence the loan amount you qualify for.

Pag-IBIG Housing Loan Requirements

To apply for a Pag-IBIG Housing Loan, you need to meet certain eligibility criteria and provide specific documents. Here’s a detailed list of the requirements

Eligibility Requirements

- Active Member: At least 24 months of contributions.

- Age: At least 18 years old but not older than 65 at loan maturity.

- Income Proof: To demonstrate repayment capacity.

- Good Credit Standing.

Required Documents

- Loan Application Form: Completed Pag-IBIG Housing Loan Application Form (HLA).

- Membership ID: Pag-IBIG Membership ID or proof of membership.

- Proof of Income:

- Employed: Certificate of Employment, payslips.

- Self-employed: Income Tax Return, business permits.

- OFWs: Employment contract and certificate.

- Two Valid IDs: Government-issued IDs (e.g., passport, driver’s license).

- Property Documents:

- For purchase: Transfer Certificate of Title (TCT), Contract to Sell.

- For construction: Building plans and permits.

- Tax Documents: Latest tax declaration and receipts.

- Marriage Certificate: If applicable.

Always check with Pag-IBIG for the latest requirements and guidelines

How to Apply Pag-IBIG Fund Housing Loan Online

Applying for a Pag-IBIG Fund Housing Loan online is a convenient process. Here’s a step-by-step guide to help you through the application:

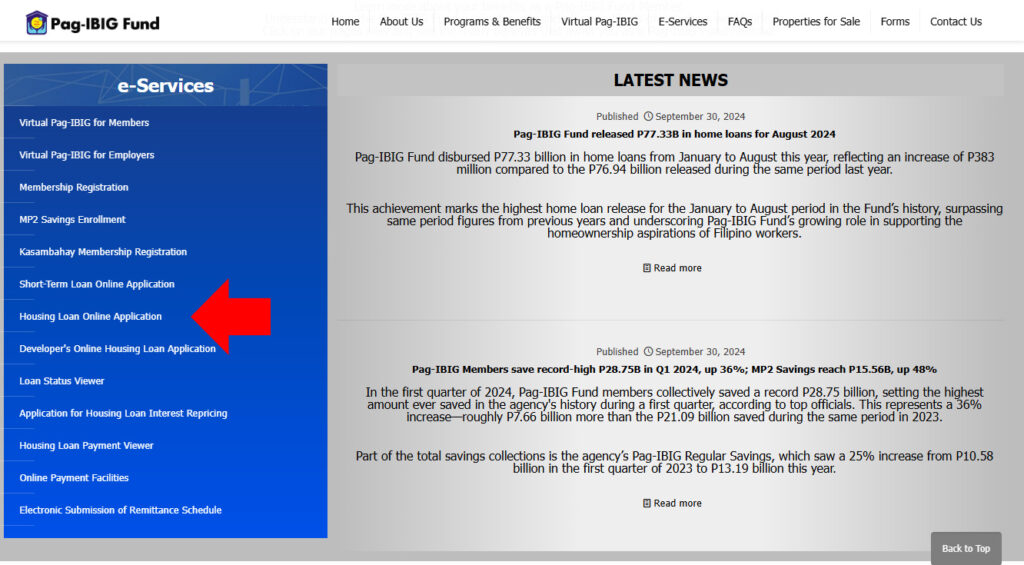

Step 1: Go to Pag-IBIG Fund Website

- Visit the Pag-IBIG website: Go to Pag-IBIG Virtual.

- Choose “Housing Loan Application Online” under the E-Services.

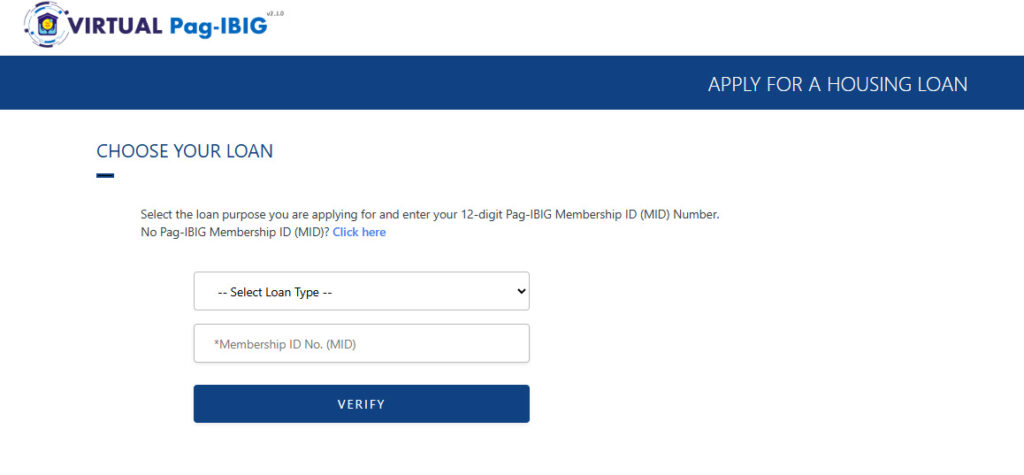

Step 2. Select Loan Type

Select what type of Loan e.g. Home Improvement, Refinancing of an existing housing loan, purchase residential lot, etc. Then enter your Pag-IBIG Membership ID No.

Step 3. Personal Info and Documents

- Fill in the necessary information: Complete the form with your personal, employment, and loan details.

- Upload your documents: Submit the scanned copies of your supporting documents (ID, proof of income, etc.).

- Submit your application: Review the form and submit.

Step 4: Wait for Assessment and Approval

After submitting your online application, Pag-IBIG will assess your documents and qualifications. You will be notified via email or SMS about the status of your application. The evaluation may take a few weeks.

Step 5: Complete Additional Requirements (if necessary)

Pag-IBIG may ask for additional documents or clarifications during the assessment process. Make sure to respond promptly.

Step 6: Sign Loan Documents and Wait for Release

Once approved, you will be required to sign the loan agreement and complete any final requirements. After this, your loan proceeds will be released.

Read Also:

- Step-by-Step Guide on How to Apply for a Pag-IBIG Housing Loan

- How to Check Your PAG-IBIG Monthly Contribution and Loan Payment History

- How to Withdraw Pag-IBIG Fund Contributions

Disclaimer: I am not affiliated or whatsoever to Home Development Mutual Fund (HDMF), this tutorial is created based on my experience and for informational purposes only, if you have problems with the system you may contact 724-4244 (Pag-IBIG) – 24/7 Call Center operation, or E-mail them at [email protected]