With the millions of Filipinos working overseas, there will come a time that people would need to find a better and an easier way of remitting money. International money transfers is one way to do it. In fact, many OFWs resort to this now instead of using remittance centers because most of the time, there’s no service fee involved.

In making international money transfers, you will be usually required to key in the SWIFT code. The SWIFT code is also known as the bank code if you transact in PayPal. Don’t worry because in this article, we will be giving you an idea on what these SWIFT codes are and how you can use it.

What is a SWIFT Code?

SWIFT or Society for Worldwide Interbank Financial Telecommunication is a network which is based in La Hulpe, Belgium. It’s a system that uniforms all global transactions that happens locally and internationally. However, it’s utilized to manage and to ensure that transactions run smoothly.

Read: How to Fund COL Financial Account using BDO Online Banking

As stated above, a SWIFT code is an international code utilized to identify banks and other business parties. In addition to that, SWIFT codes are used to route financial transactions globally.

What this does is that it ensures that the funds are quickly transferred and secured to the correct and appropriate bank. Other names for the SWIFT code are:

- BIC or Business Identifier Code

- BIC Code

- SWIFT I.D.

- SWIFT-BIC

The SWIFT code generally consists of eight (8) to eleven (11) characters and can be usually seen in the following format/s:

- Four (4) character bank code;

- Two (2) character country code;

- Two (2) character location code; and

- *Optional Three (3) character branch identifier

For example, for BPI, the SWIFT code would be: BOPIPHMM

- BOPI = Bank of the Philippine Islands;

- PH = Philippines

- MM = Metro Manila

Why is it important to use a SWIFT code?

The SWIFT code usually is used for international transactions. It exists because it is what tells remittance centers and banks where the money is going to be sent. This is the reason why you need this code every single time you transfer funds internationally. Whether it’s from outside your country or if it’s going to come from the Philippines.

If you are sending cash or funds abroad, you would need the SWIFT code of the recipient’s bank before you can successfully push for a money transfer. On the other side of the page, if you are receiving money abroad and it’s going to be a transfer, you need to give out the SWIFT code of your bank to the sender.

I have multiple banks, how do I find the SWIFT code?

Providing an incorrect SWIFT code can lead to losing money. As a matter of fact, a lot of disputes and complaints about money not being received revolve around the idea of providing or submitting an incorrect SWIFT code.

In order for you to know what the correct SWIFT code of your bank is, you can visit the SWIFT website and search for your respective bank/s there.

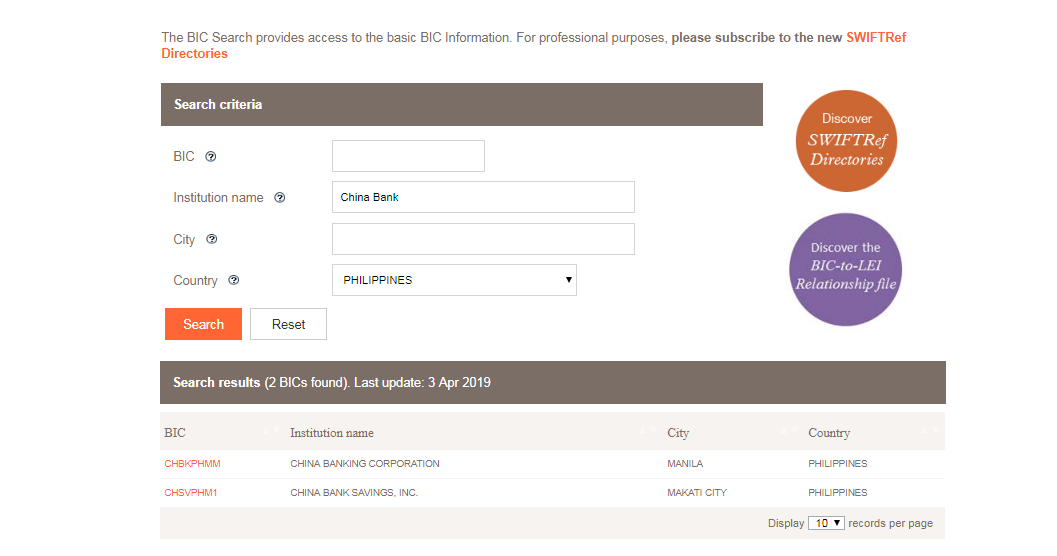

Using the Online BIC Search Tool

- Provide the bank name in the Institution Name field

- Of course, choose Philippines from the country drop down menu

- Enter the code or the CAPTCHA. Hit on Challenge after.

- Click on Search

Alternatively, you can phone your bank’s customer service hotline and ask for their SWIFT code. However, the only downside to this is that you would have to endure the long queues of customers calling.

Read: Contact Numbers of Philippine Banks You Need To Know In Cases Of Emergency

We’re going to cut you off some slack; we will be providing the Swift Codes of the top banks of the Philippines in this article.

Top Philippine Banks SWIFT Codes

| Bank Name | SWIFT Code |

| Asia United Bank Corporation (AUB) | AUBKPHMM |

| BDO Unibank, Inc. (BDO) | BNORPHMM |

| Bank of the Philippine Islands (BPI) | BOPIPHMM |

| BPI Direct | BPDIPHM1 |

| BPI Family Savings Bank | BPFSPHM1 |

| BPI Globe Banko Inc. | BPGOPHM1 |

| China Banking Corporation (China Bank) | CHBKPHMM |

| Citibank, N.A. – Makati Branch | CITIPHMX |

| Citibank, N.A. – Manila Branch | CITIPHMXTSU |

| Citibank, N.A. – Cebu Branch | CITIPHMXCBU |

| Development Bank of the Philippines (DBP) | DBPHPHMM |

| East West Banking Corporation (EastWest Bank) | EWBCPHMM |

| The Hongkong and Shanghai Banking Corporation Ltd – Philippine Branch (HSBC Philippines) | HSBCPHMM |

| HSBC Savings Bank (Philippines) Inc. | HBPHPHMM |

| Land Bank of the Philippines | TLBPPHMM |

| Metropolitan Bank and Trust Co. (Metrobank) | MBTCPHMM |

| Philippine National Bank (PNB) | PNBMPHMM |

| Rizal Commercial Banking Corporation (RCBC) | RCBCPHMM |

| Security Bank Corporation | SETCPHMM |

| Union Bank of the Philippines | UBPHPHMM |

If you were not able to see your bank in the list above, then you must be a member of a different bank. As mentioned above, the list only contains some of Philippines’ top banks. That doesn’t necessarily mean that those are the banks in our country.

Read: Charges for ATM Withdrawal and Balance Inquiry of Philippine Banks

Here are SWIFT codes of other banks which can be found in the Philippines:

| Bank Name | SWIFT Code |

| Australia and New Zealand Banking Group Limited | ANZBPHMX |

| Bangkok Bank Public Company Limited, Manila Branch | BKKBPHMM |

| Bank of America, N.A. Manila | BOFAPH2X |

| Bank of China, Manila Branch | BKCHPHMM |

| Bank of Commerce | PABIPHMM |

| BNP Paribas, Manila Offshore Branch | BNPAPHMM |

| Cathay United Bank Co., LTD. Manila Branch | UWCBPHMM |

| China Bank Savings, Inc. | CHSVPHM1 |

| CTBC Bank (Philippines) Corp. | CTCBPHMM |

| Deutsche Bank AG | DEUTPHMM |

| Equicom Savings Bank, Inc. | EQSNPHM1 |

| First Commercial Bank, Ltd., Manila Branch | FCBKPHMM |

| Hua Nan Commercial Bank, Ltd., Manila Branch | HNBKPHMM |

| Industrial Bank of Korea, Manila Branch | IBKOPHMM |

| ING Bank N.V. | INGBPHMM |

| JPMorgan Chase Bank, N.A., Manila Branch | CHASPHMM |

| KEB Hana Bank | KOEXPHMM |

| Maybank Philippines, Inc. | MBBEPHMM |

| Mega International Commercial Bank Co., Ltd., Manila Branch | ICBCPHMM |

| Mizuho Bank, Ltd., Manila Branch | MHCBPHMM |

| MUFG Bank, Ltd., Manila Branch (formerly Bank of Tokyo-Mitsubishi UFJ) | BOTKPHMM |

| Philippine Bank of Communications (PBCOM) | CPHIPHMM |

| Philippine Business Bank | PPBUPHMM |

| Philippine Savings Bank (PSBank) | PHSBPHMM |

| Philippine Veterans Bank | PHVBPHMM |

| Philtrust Bank (Philippine Trust Company) | PHTBPHMM |

| Robinsons Bank Corporation | ROBPPHMQ |

| Shinhan Bank Manila Branch | SHBKPHMM |

| Standard Chartered Bank – Makati Branch | SCBLPHMM |

| Standard Chartered Bank – Manila Branch | SCBLPHMMEQI |

| Sterling Bank of Asia Inc. | STLAPH22 |

| Sumitomo Mitsui Banking Corporation Manila Branch | SMBCPHMM |

| Taiwan Cooperative Bank Manila Offshore Banking Branch | TACBPHMM |

| United Coconut Planters Bank (UCPB) | UCPBPHMM |

| United Overseas Bank Limited – Manila Branch | UOVBPHMM |

| Yuanta Savings Bank (formerly Tong Yang Savings Bank) | TYBKPHMM |

NOTE: This list was taken from the table Money Max PH gave.

Philippine Bank Codes

Philippine bank codes, on the other hand are codes that are used by financial institutions to be able to transfer to Philippine local banks. Bank codes or more commonly known as the Bank Routing Symbol Transit Number (BRSTN), is given to a bank and is used to identify its legal name, city, and country in financial transactions.

Read: Banks in the Philippines: Maintaining Balance of Different Account Types

It has nine (9) digits and is a standard bank identifier for receiving and sending money in and from the Philippines.

When are bank codes used?

If you do normal banking transactions, chances are, bank codes would be a completely new thing for you. The more familiar uses of bank codes is if you withdraw funds from PayPal accounts to the local bank account. Since PayPal has their headquarters overseas, they would have to provide the SWIFT and bank codes of the users’ banks.

You can find a bank code after you register in PayPal. In PayPal, they generally provide the list of bank codes in the Philippines when you sign in. After logging in:

- Hit on “Wallet” on the top category links;

- Under Bank Accounts, hit on “Link a bank account;“

- Click on Add;

- Select the “List of bank codes” which is next to the Bank Code field;

- You will be redirected to a link where it displays the list of bank codes of banks in the Philippines.

You might have the challenge in finding the correct BRSTN or the bank code in PayPal’s list. So, here’s a more organized list. These banks are arranged alphabetically.

| Bank Name | SWIFT Code |

| Asia United Bank Corporation (AUB) | 11020011 |

| Australia and New Zealand Banking Group Limited | 10700015 |

| Bangkok Bank Public Company Limited | 10670019 |

| Bank of America, N.A. | 10120019 |

| Bank of China | 11140014 |

| Bank of Commerce | 10440016 |

| Bank of the Philippine Islands (BPI) | 10040018 |

| Bank of Tokyo-Mitsubishi, Limited | 10460012 |

| BDO Unibank, Inc. (BDO) | 10530667 |

| China Banking Corporation (China Bank) | 10100013 |

| China Bank Savings, Inc. | 11129996 |

| Citibank, N.A. | 10070017 |

| CTBC Bank (Philippines) Corp. | 10690015 |

| Deutsche Bank AG | 10650013 |

| Development Bank of the Philippines (DBP) | 10590018 |

| East West Banking Corporation (EastWest Bank) | 10620014 |

| Equicom Savings Bank, Inc. | 10960017 |

| First Consolidated Bank | 20780012 |

| Industrial Bank of Korea | 11310019 |

| JPMorgan Chase Bank, N.A. | 10720011 |

| KEB Hana Bank | 10710018 |

| The Hongkong and Shanghai Banking Corporation Ltd – Philippine Branch (HSBC Philippines) | 10060014 |

| Land Bank of the Philippines | 10350025 |

| Maybank Philippines, Inc. | 10220016 |

| Mega International Commercial Bank Co., Ltd. | 10560019 |

| Metropolitan Bank and Trust Co. (Metrobank) | 10269996 |

| Mizuho Bank, Ltd. | 10640010 |

| MUFG Bank (formerly Bank of Tokyo-Mitsubishi UFJ) | 10460012 |

| Philippine Bank of Communications (PBCOM) | 10110016 |

| Philippine National Bank (PNB) | 10080010 |

| Philippine Savings Bank (PSBank) | 10470992 |

| Philippine Veterans Bank | 10330016 |

| Philippine Trust Company | 10090039 |

| Rizal Commercial Banking Corporation (RCBC) | 10280014 |

| Robinsons Bank Corporation | 11070016 |

| Security Bank Corporation | 10140015 |

| Shinhan Bank | 11300016 |

| Standard Chartered Bank | 10050011 |

| Sterling Bank of Asia Inc. | 11190019 |

| Sumitomo Mitsui Banking Corporation | 11280013 |

| Union Bank of the Philippines | 10419995 |

| United Coconut Planters Bank (UCPB) | 10299995 |

| United Overseas Bank Philippines | 10270341 |

| Yuanta Savings Bank (Formerly Tong Yang Savings Bank) | 11130011 |

Now that you know what the SWIFT codes are for, you can definitely take advantage of this opportunity to be able to send and receive money abroad! More so, you now know your bank codes so be sure that it’s always correct.

Read: When and Why Should You Get a Credit Card?

Feel free to bookmark this specific article if you do international money transfers or transactions so you don’t have to search for it anymore.