Are you aware that there are Charges for ATM Withdrawal and Balance Inquiries with another bank’s automated teller machine (ATM)? Yes, you heard that right.

Well, if you’re not aware, you should be cautious. Why? You might be shocked when you see charges on your account which you do not remember. Although they charge you for every transaction, a withdrawal transaction is charged differently from a normal balance inquiry.

Starting April 7, 2021, banks adjust their charges can amount from P10.00 to P18.00 for every withdrawal transactions and P1.00 to P2.00 when you do a balance inquiry.

Note that different banks have different charges; that’s what this article is all about.

Charges for ATM Withdrawal and Balance Inquiry of Philippine Banks

Listed below is a chart that dictates how much your bank charges you for every interbank transaction you make.

| Bank | Withdrawal Fee (₱) | Balance Inquiry Fee (₱) |

|---|---|---|

| BDO Unibank, Inc. | 18 | 2 |

| BPI (Bank of the Philippine Islands) | 18 | 2 |

| Metrobank | 18 | 2 |

| China Bank | 16 | 2 |

| PNB (Philippine National Bank) | 15 | 2 |

| Security Bank | 10 | 1 |

| Landbank | 10 | 1 |

| Union Bank | 18 | 2 |

| RCBC | 14 | 2 |

| DBP (Development Bank of the Philippines) | 15 | 2 |

| EastWest Bank | 11 | 1 |

| Robinsons Bank | 18 | 2 |

| PSBank (Philippine Savings Bank) | 10 | 1 |

| UCPB (United Coconut Planters Bank) | 15 | 2 |

| AUB (Asia United Bank) | Varies* | Varies* |

* Note: For some banks like AUB and others, fees depend on the ATM operator or vary regionally

To summarize, some banks debit as low as P10.00 while some charge P15.00. However, banking-giants like Citibank won’t charge you for anything.

NOTE: The charges here are deducted from your account. The banks listed is the representation of your ATM card not the ATM itself. So to narrate it, if you use your Bank of the Philippine Islands (BPI) card elsewhere, expect a P18.00 deduction (for withdrawals) and P2.00 (for a balance inquiry)

Now that you know how much you are being deducted for each transaction in another bank, use it as an advantage. Of course, your bank is not scattered throughout the Philippines. There are some areas that won’t have your bank around so you have no other options.

Read: Banks in the Philippines: Maintaining Balance of Different Account Types

In addition to that, some banks have inter-branch fees.

What is an inter-branch fee?

The inter-branch fee is the fee debited from your account when you perform over-the-counter transactions from a different branch from which you opened your account.

Let me give you a concrete example; you opened your XXXX bank account in Metro Manila a month from now. Currently, you are in Cebu and you need to perform over-the-counter transactions. Since you are performing that OTC transaction from a DIFFERENT branch, you are subject to this charge.

What are the banks that incur this inter-branch fee?

Metrobank

Metrobank charges inter-branch transaction fees for certain over-the-counter services. As of the latest updates:

Read: Applying for an ATM Bank Account in Metrobank

BDO

The BDO rule, however, is quite different.

Deposit: P50.00

Withdrawal:

- Regional (Province-to-Province) – P200.00

- Intra-regional (Metro MNL-to-Province) – P100.00

BPI – Bank of the Philippine Islands

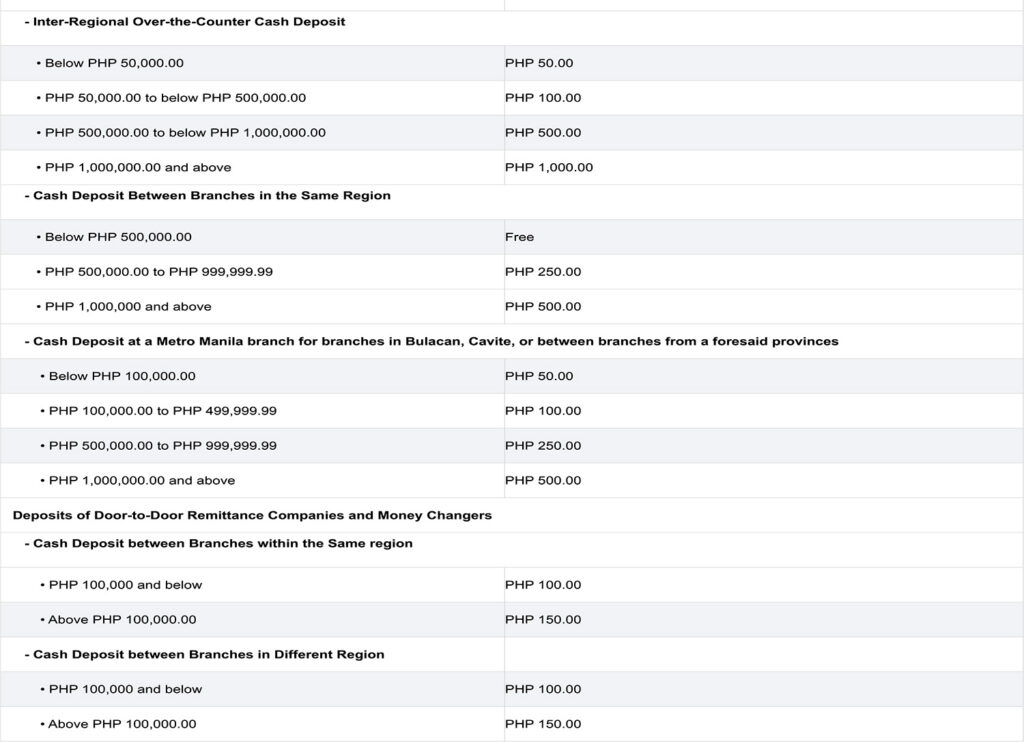

Inter-region – any branch other than branch of account, in a different region, e.g. NCR to Region I, etc.

| Below Php 50K | Php 50 |

| Php 50K to Php 499K | Php 100 |

| Php 500K to Php 999K | Php 500 |

| Php 1M and above | Php 1,000 |

Read: How To Enroll BDO Online Banking From Abroad

Now that you know the following fees, use them as a guide for you to avoid charges and other fees that might be incurred in your account.

Disclaimer: The information provided regarding charges for ATM withdrawal and balance inquiry fees of Philippine banks is for general reference only and may vary depending on the bank’s policies, ATM location, and applicable regulations. Fees are subject to change without prior notice, and banks may implement additional charges based on transaction types or specific circumstances. For the most accurate and up-to-date information, customers are encouraged to verify directly with their respective banks or consult official bank communication channels.

Read Also:

- BDO ERP (Easy Redemption Plan) – UITF Review and Requirements

- How Can I View My BDO Savings Account Withdrawal History

- BDO Funds Transfer and Send Money To Any BDO Account

Featured Image from Magacitizens.com

BPI has interbranch fee too of 50php