The Social Security System (SSS) is the government-run social insurance program for private sector employees. They offer a lot of benefits and social security programs for their members. I’m aware that all employees have an idea of how the SSS Pension works.

But that’s not what we’re going to talk about today. Today, we will be tackling a more useful benefit; we’ll be talking about the SSS Pension Loan Program or the PLP.

In this article, we will discuss what the SSS Pension Loan Program is, who is eligible for it, how SSS members can use it – everything you need to know about it.

What is the SSS Pension Loan Program?

The SSS Pension Loan Program (PLP) is a loan facility offered by the SSS to help active SSS retiree pensioners meet short-term financial needs without resorting to high-interest loan options from private lenders. The program allows qualified pensioners to borrow against their future pensions, providing access to funds while ensuring that repayments are manageable and deducted from their monthly pension.

Eligibility: Only SSS retiree pensioners who are receiving their monthly pensions and meet specific age and other criteria are eligible.

Loan Amount: Pensioners can borrow up to three, six, or nine months’ worth of their monthly pension, depending on their eligibility.

Repayment: The loan is repayable over a maximum term of 24 months through automatic deductions from the pensioner’s monthly pension.

Interest Rate: The program offers a relatively low interest rate compared to private loans.

Purpose: It aims to help pensioners manage urgent financial needs, such as medical expenses, home repairs, or personal emergencies.

Eligibility Requirements for SSS Pension Loan Program?

Other than being a pensioner, the SSS Pension Loan Program would require interested applicants to at least meet the following requirements:

- Must be receiving your monthly pension for at least one month and have no existing pension loans.

- Must be below 85 years old at the end of the loan term.

- The potential applicant should have no deductions such as an outstanding balance or a benefit overpayment payable to the SSS

- Must have no advanced pension plan/program under the SSS Calamity Benefit

- Must have an approved disbursement account enrolled.

- Must have updated contact information (cellular/mobile number, email, and mailing address).

How much can you borrow from the SSS Pension Loan Program?

The loan amount that eligible pensioners can borrow is based on the Basic Monthly Pension (BMP) of the pensioner; along with the additional P1,000.00 benefit.

Read: How Much Will People Get From the SSS Retirement Benefit and How They can Get it

It is worth noting too that the pension of the dependent, in this regard, is not included. That being said, the borrower is given the option to avail of any of the following loanable amounts but must not exceed the maximum loan limit of P200,000.

- 3 x the (BMP + P1K additional benefit)

- 6 x the (BMP + P1k additional benefit)

- 9 x the (BMP + P1k additional benefit)

- 12 x the (BMP + P1k additional benefit)

For instance, if the basic monthly pension is P2,000; and the pensioner chooses the 6 x option, it’ll be 6 x P2,000 + P1k, totaling P18,000.00.

How to Apply for SSS Pension Loan Program?

1. Register or Log in to My.SSS Account

- Go to the official SSS website (https://member.sss.gov.ph/members/).

- Log in using your credentials. If you don’t have an account, you’ll need to register first you can follow our guide how to register SSS online.

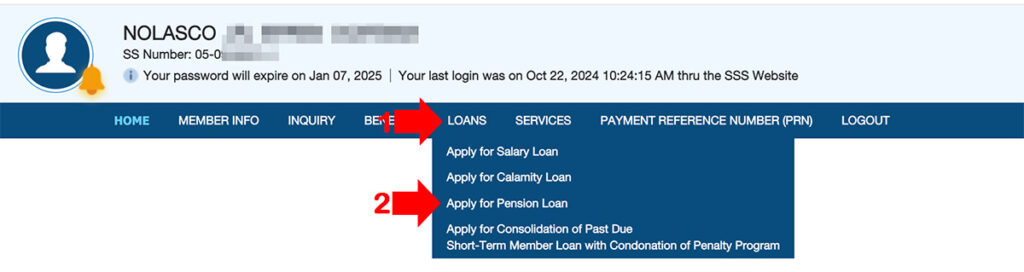

2. Navigate to the Pension Loan Application

After logging in, click on Loan from the main menu, then select Apply for Pension Loan.

4. Choose Loan Amount

You will be shown the loanable amounts, typically up to three, six, or nine months’ worth of your pension. Select the amount you want to borrow.

5. Submit Your Application

Confirm your details and loan amount, then submit the application. Make sure to review everything before finalizing.

6. Wait for Approval and Disbursement

Once submitted, the SSS will review your application. You can monitor the status of your loan through the My.SSS account. Once approved, the loan will be credited to your UMID-ATM card or your registered bank account.

Why should you choose the SSS Pension Loan Program instead of regular loans?

Other than the fact that it’s one (1) of the main benefits of the agency, it can also benefit its members one way or another. The program holds a certain amount of benefit and importance to SSS members that everyone should know about.

Read: The Updated SSS Contribution Table

1. Flexible and light repayment terms

The monthly amortization of the loan will be deducted from the monthly pension that the pensioner will get. Basically, the pensioner is not required to “remit;” it will automatically be deducted from the pension.

The deduction is also dependent on the amount that the pensioner loaned. It goes as follows:

Loaned Amount | Repayment Term |

| (BMP + P1K benefit) x 3 | Six (6) months |

| (BMP + P1K benefit) x 6 | Twelve (12) months |

| (BMP + P1K benefit) x 9 | Twenty-four (24) months |

| (BMP + P1K benefit) x 12 |

As you can see, the repayment terms are flexible and it’s not like how financial institutions would ask for repayment. The repayment process would be cut down from the monthly pension received by the pensioner.

Read: How to Apply For The SSS Housing Loan For Repairs and/or Improvements

As per the SSS, the first (1st) monthly amortization payment would be due on the second (2nd) month after the loan was granted. For instance, if the loan was granted on March, the first (1st) monthly amortization would be deducted from the monthly pension for May.

2. Low interest rates

Another benefit of that the SSS Loan Pension Program provides is its low interest rates. The SSS is known to have smaller interest rates than those of the banks.

Meaning, it is more flexible and more attainable especially to people who aren’t earning that much. Because of this, the SSS Loan Pension Program is one of the best choices for seniors or retirees. With only an interest rate of ten (10) percent per annum until it’s fully paid, it’s really a good deal.

Read: SSS Loan – Condonation Program and Loan Restructuring Program (LRP)

It is also worth noting that it’s computed on a principal balance that will diminish, becoming a part of the monthly amortization.

3. No processing or service fee

Unlike other financial and banking institutions who issue loans, the SSS pension loan program would not cut off anything from the credit to the pensioner. According to them, the SSS will be waiving the one (1) percent collection service fee to subsidize the payment of the premium of the Credit Life Insurance (CLI) by the pensioner/borrower.

Applying for the SSS Pension Loan Program is easy. In fact, it could be one of the most beneficial and most efficient loan programs in the country. It is, however, only available to pensioners. So if you know a pensioner who needs to borrow money, the SSS Pension Loan Program might be the one they’ll choose.

Read: SSS Guide: How do You Compute The SSS Monthly Pension?

What are you waiting for? If you know someone who might need this service, go and make their lives easier by sharing this to them! The SSS Pension Loan Program might just be the service you’ve been looking for.

Frequently ASk Questions (FAQ)

Who is eligible to apply for the SSS Pension Loan Program?

Only active retiree pensioners of the Social Security System (SSS) who have been receiving their pension for at least one month and are under 85 years old at the end of the loan term are eligible. Pensioners must also not have an existing pension loan.

How much can I borrow under the SSS Pension Loan Program?

Pensioners can borrow up to three, six, or nine months’ worth of their monthly pension, subject to SSS guidelines. The maximum loan amount depends on the pensioner’s eligibility and need.

How is the pension loan repaid?

Repayments are automatically deducted from the pensioner’s monthly SSS pension. The loan term can be up to 24 months, depending on the amount borrowed.

What are the interest rates for the SSS Pension Loan?

The loan is subject to a relatively low interest rate of 10% per annum, calculated on a diminishing balance basis.

How long does it take to get the loan approved?

Once the application is submitted, loan approval usually takes a few working days. The pensioner can track the application status through their My.SSS account.

How will I receive the loan proceeds?

The loan amount will be credited to the pensioner’s UMID-ATM card or their registered bank account.

Can I apply for the SSS Pension Loan online?

Yes, the SSS Pension Loan Program can be applied for online through the My.SSS Member Portal, making the process more convenient for pensioners.

Can I apply for a new loan if I still have an outstanding pension loan?

No, pensioners must fully repay their existing pension loan before applying for another one.

What happens if I default on my pension loan?

Since the loan is automatically deducted from your monthly pension, default is unlikely unless your pension is interrupted. However, failure to repay could affect future loan applications and incur penalties.

Can I prepay the loan early?

Yes, pensioners have the option to fully repay the loan before the term ends without penalties.

Disclaimer: The information provided about the SSS Pension Loan Program is for general informational purposes only. While we strive to ensure accuracy, policies and procedures may change over time. It is the responsibility of the user to verify the latest details directly from official SSS sources. We do not represent or have any affiliation with the Social Security System (SSS). Always consult the official SSS website or contact their offices for up-to-date information.

REFERENCES:

- SSS (https://www.sss.gov.ph/pension-loan-first-time-applicants/)

how many days to claim the sss pension loan?