In the ever-evolving landscape of digital finance, mobile wallets have become an integral part of our daily lives. GCash, a leading mobile wallet in the Philippines, has introduced a groundbreaking feature that takes digital financial transactions to the next level—the GCash Visa Card.

In this article, we are going to guide users through the process of obtaining and utilizing the new GCash Visa Card, exploring its features and benefits that can empower individuals to manage their finances efficiently.

Read: Go cashless in Singapore, Malaysia, South Korea, and Japan with GCash and Alipay+

What is a GCash Visa Card?

The new GCash Visa Card allows users to pay for purchases both online and in-store, using the GCash app. Additionally, you can use it to make ATM withdrawals from your GCash account.

One of the biggest card payment companies in the world, Visa, powers the new GCash Visa Card. Your card will therefore have the Visa logo on it. The amount on this reloadable prepaid card is determined by the balance in your GCash account.

Read: How To Earn Money in GCash Without The Referral Program

What are the GCash Visa Card Features?

- EMV chip: a 16-digit card number, and a three-digit CVV

- Virtual Account Number or the 12-digit reference number

- A daily withdrawal limit of ₱40,000 and a limit of ₱20,000 per single ATM transaction

Differences between the New GCash Visa Card from the Old GCash Mastercard?

Both the GCash Mastercard and Visa cards function essentially in the same way. The appearance could be the primary distinction. Important information about the GCash Mastercard is located on the face of the card, including the card number and expiration date. But the name of the cardholder is hidden.

In contrast, the GCash Visa card takes a more straightforward method. The cardholder’s name is the only information printed on the front of the card. The back of the card contains important information such as the virtual account number, CVV, expiration date, and card number.

A few months back, GCash stopped accepting Mastercard card orders. It will only utilize Visa from now on.

Read: How to earn money in GCash (5 ways)

How to Apply for a GCash Visa Card?

The card cannot be obtained unless you have a fully verified GCash account, as previously specified. The actions you need to take are as follows:

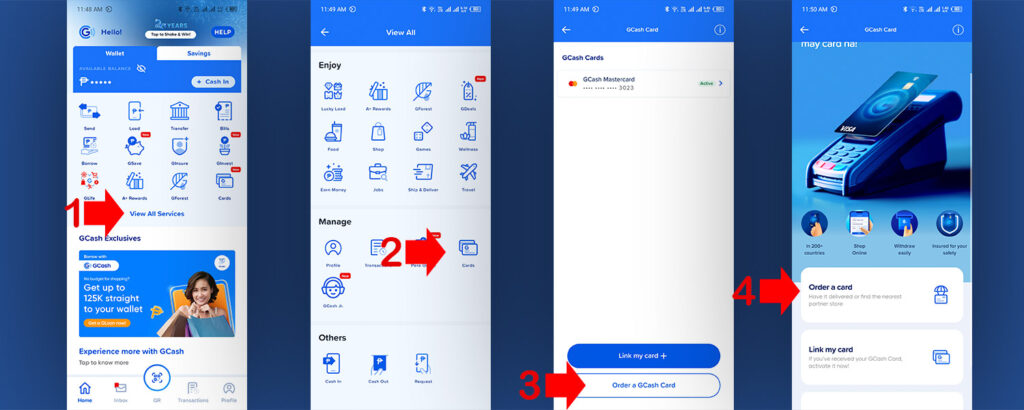

Step 1: Open the GCash application. Click View All Services from the homepage.

Step 2: Scroll down and select Cards from Manage categories.

Step 3: Select Order a GCash Card.

Step 4: Choose Order a Card on the ensuing page.

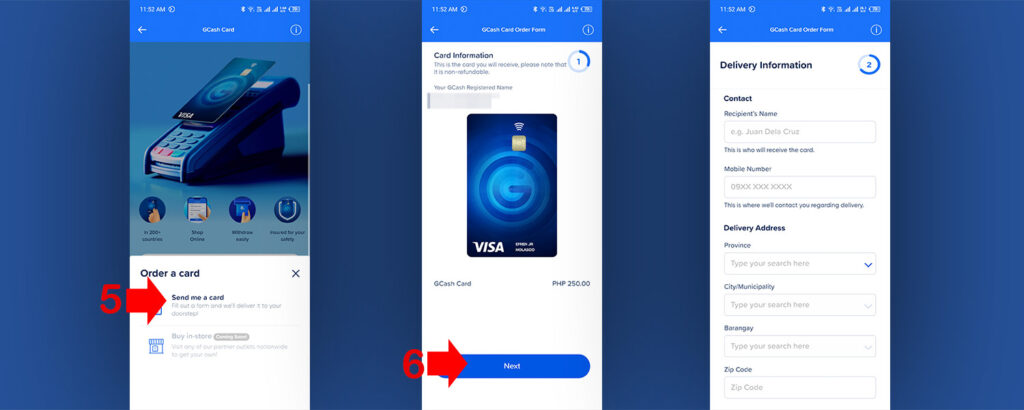

Step 5: Select Send Me a Card then, Next.

Step 6: Fill out the Delivery Information form. Then press Next.

Step 8: Hit Pay.

GCash Visa Card Price: The total GCash Card price: ₱250— ₱185 for the card and ₱65 for the delivery.

Read: How to verify a GCash account using Student ID (Two Options)

How to Use the GCash Visa Card?

It will arrive at your address a few days after you finish the online Order GCash Card. The following information will help you configure it and use it for your different transactions:

By connecting it to your GCash account, you can achieve this. These are what to do:

Step 1: Open the GCash application. Click View All from the homepage.

Step 2: Choose Cards on the following page.

Step 3: Select Link My Card.

Step 4: Enter the six-digit code for authentication and click Submit.

Step 5: Enter the necessary data, including your virtual account number and the last four numbers of your card, on the following screen. Next, press Submit.

Step 6: After successfully linking your GCash Card to your GCash account, you’ll get a prompt.

Step 7: You’ll be asked to select the six-digit PIN associated with your card. You will use this PIN each time you make an ATM withdrawal or make a purchase at a store that accepts credit or debit cards.

Read: How to transfer funds from PayPal to GCash

The introduction of the GCash Visa Card marks a significant stride towards a cashless and convenient financial ecosystem in the Philippines. By following the steps outlined in this guide, users can seamlessly integrate the GCash Visa Card into their daily lives, enjoying the benefits of secure transactions, enhanced financial management, and exclusive rewards.

As digital finance continues to evolve, the GCash Visa Card stands as a testament to the innovative solutions that empower individuals on their journey towards financial freedom.