As an active member of the Filipino workforce, you may need to invest in several types of insurance. Among others, you may shell out monthly for life insurance, car insurance policy, health insurance, and others to secure yourself and your family.

One insurance option you can avail of today comes from the Social Security System (SSS), which is designed to provide enrolled employees with a host of exclusive benefits for retirement and other life events. The beauty of SSS membership is that you may also take advantage of their salary loans should you require a handy yet trustworthy source of credit.

Who is eligible for an SSS salary loan?

Before you can apply for an SSS salary loan, you must first meet eligibility requirements. You must be: an SSS member who is currently employed, self-employed, or a voluntary contributor with at least 36 posted monthly payments to your name. Six of those monthly contributions have to have been made within the year (12 months) prior to you filing your loan application.

Aside from these requirements, you must be below 65 years old and have not yet availed of any “final benefits,” such as in the case of total permanent disability, retirement, or death, from the SSS. Your employer must be fully updated on the monthly contributions you have made, and you must not have been disqualified due to a previous case of fraud against the SSS.

Read Also:

- How to Check SSS Contributions Online

- How to get authenticated PSA certificate online (Birth certificate, Marriage certificate, Death certificate and Certificate of no Marriage or CENOMAR)

- How to apply NBI Clearance Online

How to Apply for a Salary Loan Online?

The good news is that there’s now no need for you to take a day off from work and line up all afternoon at the nearest SSS office to get a loan. Before you apply, you must have already asked your employer for certification that you’re getting a loan and verified that you’ve made the full 36 monthly SSS contributions.

Take the following steps when signing up for an SSS salary loan via the Internet:

Step 1: Login to My.SSS account

Go to the official SSS website and register for a My SSS account using your full name, SSS number, date of birth, and email address. Once you’ve successfully registered, go back to the main page and log in with your new username and password. (If you already have a My.SSS account, you can log in and proceed to the next step.)

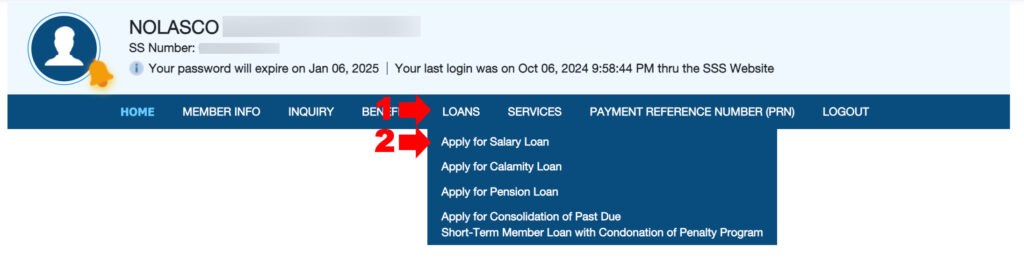

Step 2: Access Salary Loan Page

On the home page, click on Loans and then access “Apply Salary Loan.”

Step 3: Review Loanable Amount

The system will automatically display the loanable amount based on your monthly contributions. You can apply for a one-month or two-month salary loan depending on your contribution history. Review the loan terms and the amount to be borrowed, including interest rates and repayment schedule.

Step 4: Select Bank or Disbursement Channel

You will be asked to choose a disbursement option. Select the SSS-disbursed preferred method for receiving your loan:

- SSS UMID-ATM card (if registered and activated as an ATM card).

- Bank Account: You can choose an accredited bank account where your loan will be credited.

- eWallet: You can also select PayMaya or other eWallet services registered with SSS for loan disbursement.

Step 5: Submit Your Loan Application

Once you’ve reviewed the details and selected your disbursement method, click Submit to finalize your application. The system will provide a Transaction Number as proof of your loan application.

Step 6: Wait for Approval

After submitting your loan application, wait for SSS to process and approve your request. You can check the status of your loan by logging into the SSS portal and selecting Inquiry > Loans Info to monitor the approval status.

Step 7: Receive the Loan Proceeds

Once your loan is approved, the amount will be credited to your selected disbursement channel. You will also receive an email or SMS confirmation.

Still find the process too complicated? You can try downloading the Member Loan Application form from the SSS website. Once you’ve finished filling out the form, take it to your local SSS office for processing. Note that if you’ve already been approved for a salary loan in the past, you have to make sure the previous loan has been paid or else, you won’t qualify.

This post is brought to you by:

MoneyMax.ph is the Philippines’ leading financial comparison site where you can save money by comparing financial and car insurance products and services – fast, comprehensive, and free. We aim to give the power of smart purchase decisions back to Filipino consumers by providing everything they need to become financially savvy.

More Helpful tutorials from EfrenNolasco.com

- Everything you need to know about the New Postal ID

- How to Register to BDO Online Banking

- How to Pay Smart Bills Online

- How to Book Online in Cebu Pacific

- How to enroll on PNB Online Banking

- Like, Follow or subscribe to our social media account for more updates.