Since the Kuwait incident, our country is focusing on the improvement or betterment of our Overseas Filipino Workers (OFWs). We do all things that could help them in their finances, savings, and of course for their families back here in the Philippines. A lot of programs have been born like extra emergency fund from OWWA, business loan opportunities, and such. The Philippine National Bank (PNB) has their own way. The PNB OFW Savings Account has a special function that beneficiaries in the Philippines could use as well.

The good thing about the PNB OFW Savings Account program is that it doesn’t have a requirement for both initial deposit and maintaining amount. In this article, we will be detailing a guide on how you can open a PNB OFW Savings Account. This would be beneficial for OFWs and beneficiaries to save money to start small businesses and investments.

Read: Opening A LandBank Account With Php100 Initial Deposit For OFWs

If you’re interested or you know someone who is, here are some of the documentary requirements you would need to submit.

The following would be the acceptable Identification Cards (IDs) you can present upon submission of application:

- Original employment contract which should be duly notarized and certified by the POEA. This will be accepted together with at least a photocopy of passport;

- Drivers License;

- Passport;

- Professional (PRC) license;

- SSS/GSIS membership cards;

- OFW ID (issued by POEA/OWWA); and

- NBI/Police clearance

Read: List of Valid IDs here in the Philippines

All of those identification documents would hold your photograph. If you will be submitting documents without your picture, you should always accompany that with a photographed I.D.

If an applicant is ineligible due to lack of funds or identification, the client must submit 2 pieces of 1 x 1 ID picture and a letter of introduction. Both the OFW and the beneficiary can submit these for the PNB OFW Savings account application.

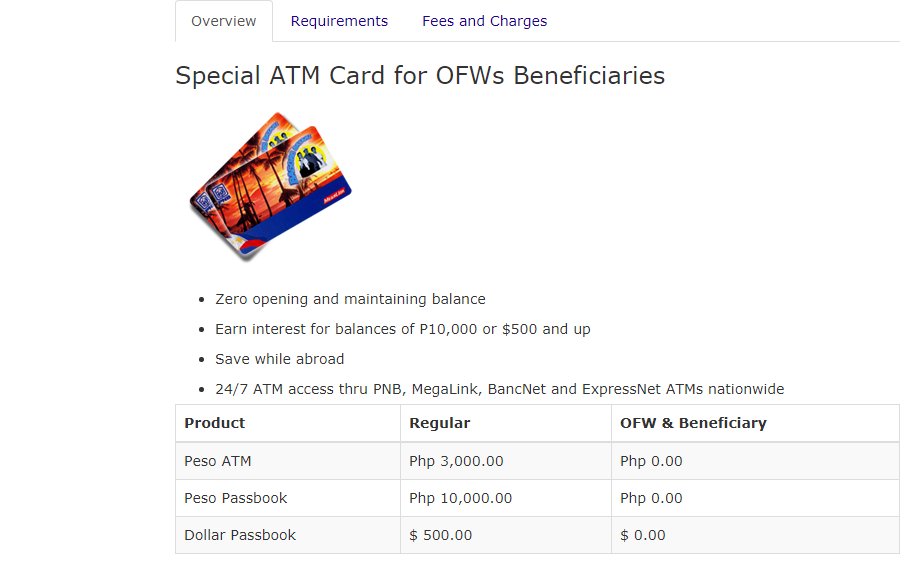

What are the fees and charges of opening a PNB OFW Savings account?

- Initial Deposit – NONE

- Maintaining Balance requirement – NONE

- Balance to earn interest – Php10, 000.00 or $1, 000.00 if a USD account

- Interest rates – 0.100% per annum

- Dormancy and Dormancy Fee – 2 years; 0 for dormancy fee

- Passbook Replacement – Php100. 00/$5.00 for USD accounts

In addition to these, different account options would be PESO ATM, PESO Passbook and/or Dollar Passbook. All of those would have the same (no balance and deposit requirement). This is one way of the PNB to help OFWs and their beneficiaries here in the Philippines have a bank account without worrying too much about the maintaining amount and deposit.

What do you think of these programs that are being out right now? Would this PNB OFW Savings Account program help OFWs further save for their families? Would this be the door to a successful return of an OFW and to not go back abroad to work?