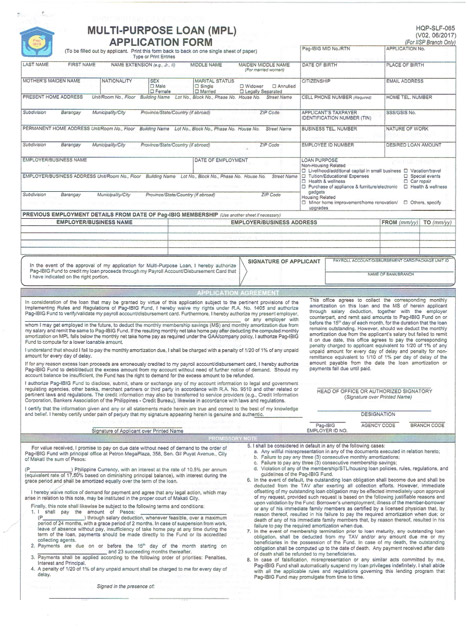

The Home Development Mutual Fund (HDMF), popularly known as Pag-IBIG (Pagtutulungan sa kinabukasan: Ikaw, Bangko, Industriya at Gobyerno) Fund offers Short-Term Loan (STL) such as Calamity Loan and the Multi-Purpose Loan (MPL).

The Pag-IBIG Multi-Purpose Loan (MPL) provide short-term financial assistance to qualified Pag-IBIG Members for any of the following purposes:

- Minor home improvement/home renovation/upgrades

- Livelihood/additional capital for small business

- Tuition/educational expenses

- Health and wellness

- Purchase of appliance, furniture or electric gadgets

- Payment of utility/credit cards bills

- Vacation/ travel

- Special events

- Car repair

- Others needs

Read: Step-by-Step Guide on How to Apply for a Pag-IBIG Housing Loan

Below are Guidelines and Instructions to apply for Pag-IBIG Multi-Purpose Loan (MPL)

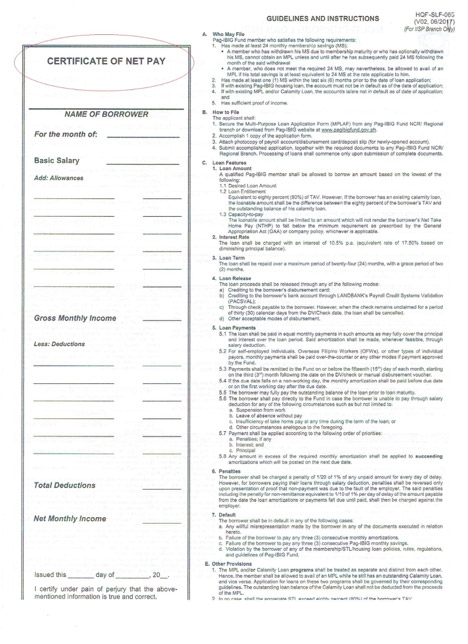

Eligibility Requirements

1. Pag-IBIG Fund member has total savings equivalent to Php. 4,800.00 or at least twenty-four (24) monthly membership savings (MS);

2. Has made at least one (1) membership savings (MS) within the last six (6) months, as of month prior to date of loan application;

3. If with existing Pag-IBIG Housing Loan, the account must not be in default as of date of application;

4. If with existing MPL and/or Calamity Loan, the account/s must not be in default as of date of application; and

5. Submission of sufficient proof of income.

Read: Pag-IBIG Housing Loan 2018: What Do You Need To Prepare? FAQs

How to Apply

The following documents should be submitted upon filing of application:

1. Completely filled-up Multi-Purpose Loan Application Form (it can be downloaded from the Pag-IBIG Fund website at www.pagibigfund.gov.ph and print back to back on one single sheet of paper or can be secured at any Pag-IBIG Fund office).

2. Prepare a Photocopy of at least 2 valid IDs

3. Attached Proof of Income, it depends on your membership categories,

a. For Employed

The “Certificate of Net Pay” portion at the back of the application form must be accomplished by the employer or submit photocopy of latest pay slip duly authenticated company’s authorized representative.

b. Self-Employed or Individual Payers

Photocopy of any of the following:

- Business/Mayors Permit;

- Commission Vouchers;

- Other valid proof of income

Loan Details

1. Loan Amount- The borrower’s loan entitlement is equivalent to 80% of his/her Total Accumulated Value (TAV).

2. Interest Rate- The loan shall be charged with an interest of 10.5% p.a. (equivalent rate of 17.50% based on diminishing principal balance).

3. Loan Term- The loan shall be repaid over a maximum period of twenty-four (24) months, with a grace period of two (2) months.

Mode of Loan Release

The loan proceeds shall be released through any of the following modes:

a) Crediting to the borrower’s disbursement card;

b) Crediting to the borrower’s bank account through LANDBANK’s Payroll Credit Systems Validation (PACSVAL);

c) Through check payable to the borrower. However, when the check remains unclaimed for a period of thirty (30) calendar days from the DV/Check date, the loan shall be cancelled.

d) Other acceptable modes of disbursement.

Loan Payments

- For employed members-salary deduction

- For voluntary members/ individual payers- over the counter

Notes:

1. Original copies of photocopied required documents must be presented for authentication.

2. Employed member-borrower may not present original copies of the photocopied required documents provided that said documents is duly certified by the employer.

3. For filing of application thru a representative, submit the following:

- Notarized Special Power of Attorney (SPA)

- At least two (2) valid IDs of both parties

The MPL is a cash loan that aims to address the member’s immediate financial needs. For you to avail of every opportunity that PAG-IBIG is offering you, hurry update your membership.

HOW TO APPLY FOR PAG-IBIG SALARY LOAN ONLINE?

- Download and accomplish the Pag-IBIG Multi-Purpose Loan Application form

- Email form to your company HR, fund coordinator, or other authorized representative along with a front and back photocopies of

- Valid ID

- Loyalty Card Plus (if applicable)

- Landbank card (if applicable)

- UCPB card (if applicable)

- DBP cash card (if applicable)

- Your company representative will then email the Employer Confirmation of STL Application to the pertinent Pag-IBIG fund department, they can send/drop your Multi-Purpose Loan documents to the nearest Pag-IBIG branch or via these email address;

Email Address

1. [email protected]

Branch – GMA Kamuning, Quezon Avenue, Commonwealth Avenue, Cubao, Marikina, Caloocan – EDSA, Valenzuela, Pasig, Mandaluyong – Shaw Zentrum, and Antipolo

2. [email protected]

Branch – Makati-Buendia I, Binan, Makati-Ayala Avenue, Makati-Buendia II, Makati-JP Rizal, Taguig – Gate 3 Plaza, Guadalupe-EDSA, Muntinlupa, SM Aura, Intramuros, Sta. Mesa, Binondo, Pasay, Las Pinas-Robinsons Place, Paranaque, Imus, Rosario, and Dasmarinas

3. [email protected]

Branch – La Union, Laoag, Vigan, Dagupan, Urdaneta, and Baguio

4. [email protected]

Branch – Tuguegarao, Solano, and Cauayan

5. [email protected]

Branch – San Fernando, Tarlac, Angeles, SBMA, Balanga, Malolos, Baliwag, Cabanatuan, and Meycauayan

6. [email protected]

Branch – Lucena, Batangas, Lipa, Calamba, San Pablo, Sta. Rosa, Calapan, and Palawan

7. [email protected]

Branch – Legazpi and Naga

[email protected]

Branch – Cebu-Ayala, Dumaguete, Talisay, Toledo, Cebu-Colon, Mandaue, Danao, Mactan, Tagbilaran, Tacloban, Calbayog, and Ormoc

9. [email protected]

Branch – Iloilo-Manduriao, Iloillo-Molo, Kalibo, San Jose de Buenavista, Roxas, Bacolod, Kabankalan, and Sagay

10. [email protected]

Branch – CDO-Lapasan, CDO-Carmen, Valencia, Butuan, San Francisco, Surigao, and Iligan

11. [email protected]

Branch – Zamboanga, Dipolog, and Pagadian

12. [email protected]

Branch – Davao-Bajada, Davao-Matina, Davao-Lanang, Digos, Tagum, Panabo, General Santos, Polomolok, Koronadal, Kidapawan, and Cotabato

Read Also:

- How to avail Home Development Fund (Pag-IBIG)–Calamity Loan

- Pag-IBIG Housing Loan: Less Requirements, and Lower Interest

Sir,nakapag apply na nga po ako 1wik ng march status lang po gusto ko malaman.sana matugunan po ninyo.salamat kc inabot ng lockdown ky d ko kung approve or reject po.

what is the email address where we send our MPL APPLICATION?

narito po: https://www.efrennolasco.com/pag-ibig-fund-multi-purpose-loan-mpl/