Inheritance tax is a levy or tariff paid by an individual who inherits or becomes heir. Either in the form of money or property from another person. The tax amount that the beneficiary pays depends on the location; tax laws differ between states and countries.

Inheritance tax becomes an issue when someone dies. It is a one-off tax paid on the value of the deceased’s estate above a set threshold.

In the Philippines, inheritance tax is the same as estate tax. It is defined by the Bureau of Internal Revenue (BIR) as thus:

“Estate tax is a tax on the right of the deceased person to transmit his/her estate to his/her lawful heirs and beneficiaries at the time of death and on certain transfers, which are made by law as equivalent to testamentary disposition. It is not a tax on property. It is a tax imposed on the privilege of transmitting property upon the death of the owner. The Estate Tax is based on the laws in force at the time of death notwithstanding the postponement of the actual possession or enjoyment of the estate by the beneficiary.”

While some laws define inheritance tax and estate tax as one and the same, others keep the two separate. For most, estate taxes are generally defined as taxes that are assessed on the assets or estate of the deceased, while inheritance taxes are assessed on the inheritances received by the beneficiaries.

In simpler terms, Philippine inheritance/estate taxes are paid by the heirs, beneficiaries, executor, or the administrator in order to transfer property to beneficiaries or an heir upon the decedent’s passing. While calculated against the value of the net estate, it is not considered a tax on property because it is only imposed at the time of the estate owner’s death.

How is Estate/Inheritance tax determined?

One can calculate Estate/Inheritance tax is by first determining the value of the previous owner’s net estate. This is done by getting the difference between the previous owner’s gross estate; as defined under Section 85 of the Tax Code, and the allowable deductions of the decedent, which is defined under Section 86.

New Estate = Gross Estate – Deductions

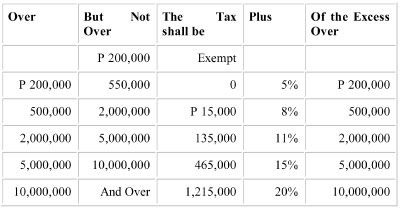

Once the values are taken, the estate tax is easily determined by referring the amount to the BIR’s Estate Tax Table, which has been in effect since 1998.

Tax Rates

Effective January 1, 1998 up to Present

Let me give you a concrete example:

If the new estate to be inherited is valued at Php 1 million, the estate tax shall be Php15,000 plus Php40,000 (or eight percent of Php 500,000). This then will total Php55,000.

Php 1 million – value of the estate Estate tax on Php 1 million – Php15,000 Plus percentage of Estate tax on the Excess – (8% X Php500,000) Estate / Inheritance Tax = Php15,000 + (8% of Php500,000) =Php55,000

Documentary Requirements when filing includes

1. Notice of Death; duly received by the BIR if gross estate exceeds P20,000 (for deaths occurring on or after Jan. 1, 1998); or if the gross estate exceeds P3,000 for deaths occurring prior to January 1, 1998

2. True copy (certified) of the Death Certificate

3. Deed of Extra-Judicial Settlement of the Estate, if the estate is settled extra judicially

4. Court Orders/Decision, if the estate is settled judicially;

5. Affidavit of Self-Adjudication and Sworn Declaration of all properties of the Estate

6. True copy (certified) of the schedule of partition of the estate and the order of the court approving the same; if applicable

7. For manually issued titles (red title):

- Certified true copy of the Original Certificate of Title (OCT);

- Transfer Certificate of Title (TCT), or Condominium Certificate of Title (CCT) in case of a condo unit

8. For electronically issued titles (blue title):

- Photocopy of the Original Certificate of Title (OCT);

- Transfer Certificate of Title (TCT), or Condominium Certificate of Title (CCT) in case of a condo unit

9. The certified true copy of the latest Tax Declaration of real properties at the time of death, if applicable.

10. “Certificate of No Improvement;” the Assessor’s Office issues this. Declared properties have no declared improvement or Sworn Declaration/Affidavit of No Improvement by at least one (1) of the transferees

11. Certificate of Deposit/Investment/Indebtedness owned by the decedent and the surviving spouse, if applicable

12. A photocopy of the Certificate of Registration of vehicles and other proofs showing the correct value of the same; if applicable

13. A photocopy of certificate of stocks; if applicable

14. Proof of valuation of shares of stocks at the time of death, if applicable

15. For listed stocks:

- Newspaper clippings or certification from the Stock Exchange

16. For unlisted stocks:

- Audited Financial Statements duly certified by an independent certified public accountant with computation of fair market value per share at the time of death

17. Proof of valuation of other types of personal properties; if applicable

18. Proof of tax credit (claimed); if applicable

19. Statement of a CPA on the itemization of assets of the decedent; itemized deductions from gross estate and the amount due if the gross value of the estate exceeds two million pesos; if applicable

20. Certification of Barangay Captain for claiming of Family Home

21. Notarized Promissory Note for “Claims against the Estate” arising from Contract of Loan

22. Accounting of the proceeds of loan contracted within three (3) years prior to death of the decedent

23. Any proof of the “Property Previously Taxed”

24. Proof of claimed “Transfer for Public Use”

25. Copy of Tax Debit Memo – as payment; if applicable

26. Special Power of Attorney (SPA) from the transacting party if the latter is not one of the parties to the Deed of Transfer

NOTE: There might be additional requirements that might be taken for presentation during audit of the tax case; depending upon existing audit procedures, so be ready.

Procedure:

1. The heirs/ representative/administrator/executor shall file the estate tax return (BIR Form 1801) and pay the corresponding estate tax with the Authorized Agent Bank (AAB), Revenue Collection Officer (RCO) or duly authorized Treasurer of the city or municipality in the Revenue District Office having jurisdiction over the place of domicile of the decedent at the time of his death, pursuant to Section 90(D) of the Tax Code, as amended.

2. In case of a non-resident decedent, the estate tax return shall be filed with the AAB of the RDO where such executor/administrator is registered or is domiciled, if not yet registered with the BIR.

3. For non-resident decedent with no executor or administrator in the Philippines, the estate tax return shall be filed with the AAB under the jurisdiction of RDO No. 39 South Quezon City.

4. The heir/authorized representative/administrator/executor shall submit all the applicable documentary requirements as prescribed in Annexes A-6 and A-6.1 of Revenue Memorandum Order (RMO) No. 15-2003 and proof of payment to the RDO having jurisdiction over the place of residence of the decedent or the RDO where the executor or administrator is registered, or RDO No. 39 – South, Quezon City, whichever is applicable. (part II, par.(4)of RMC No. 34-2013)

5. Payment of Estate Tax by installment – In case the available cash of the estate is not sufficient to pay its total estate tax liability, the estate may be allowed to pay the tax by installment and a clearance shall be released only with respect to the property, the corresponding/computed tax on which has been paid. (Section 9(F) of RR 2-2003)

Note: One-Time Transaction (ONETT) taxpayers shall mandatorily use the eBIRForms in filing all of their tax returns. They may opt to submit their tax returns manually using the eBIRForms Offline Package in the Revenue District Office having jurisdiction over the place of domicile of the decedent at the time of his death or electronically through the use of the Online eBIRForms System. (Sec. 3(2) RR No. 6-2014)

Note that the time of payment will vary depending on the law applicable at the time of the decedent’s death.

Make sure that the beneficiaries pays the estate/inheritance tax because if they fail, it can lead to a number of problems.

In most cases, real property may not be transferred from the decedents to their heirs when the estate tax return is not filed and subsequently paid. For one, this makes property more difficult to transfer to a buyer. It is important for both property owners and buyers to understand the estate tax laws in the Philippines, to make sure all acquisitions are done promptly and effectively.

Read Also:

- Everything you need to know about Real Property Tax

- How to Compute Capital Gains Tax on Sale of Real Property in the Philippines

- How to Register Your Business with the Bureau of Internal Revenue (BIR)

Source: BIR