If you are new in affiliate marketing, especially when you sign up to Hostgator and blue host affiliate program you encounter this problem and maybe this is the reason why you found this page to look for the answer how to fill out Bluehost or Hostgator tax form W8-BEN for if you’re non US residents or companies.

One of the requirements in order to get your commission in this two hosting companies is to fill out the tax form provided and if you’re non US citizen or your company outside US you may encounter problems upon filling out the form. Because they were asking for Employer Identification Number (EIN) or Social Security Number (SSN) which you don’t have.

Unlike Hostgator that you can leave EIN/SSN blank, Bluehost requires to fill out SSN or EIN in order to withdraw your earnings. Fortunately, some affiliate marketer outside US share these techniques to fill out SSN/EIN. After you read this tutorial article, all your problems regarding W8-BEN form will be solved.

How to fill out the Bluehost tax form W8-BEN if you’re non US resident or companies

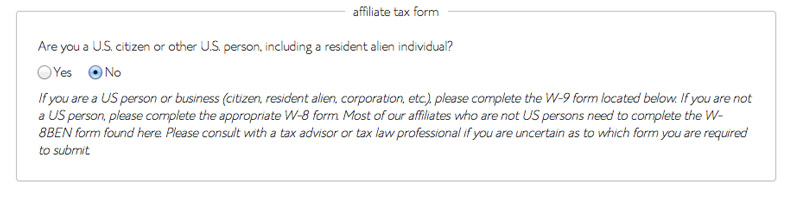

- Select “NO” because you’re not a US citizen or other.

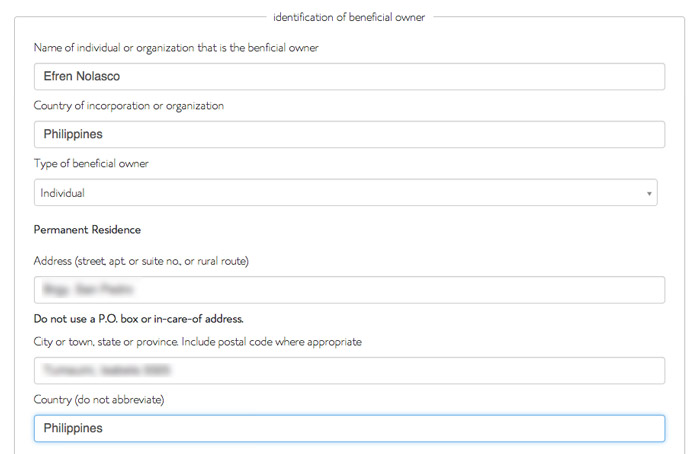

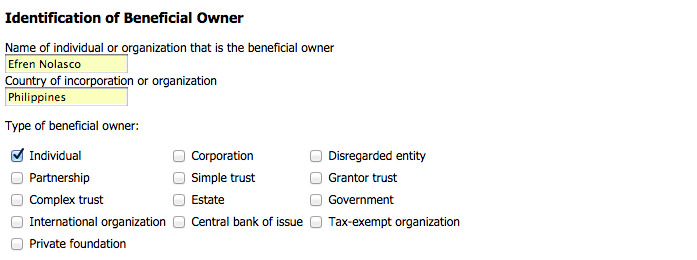

- Fill out the Identification of beneficial owner section completely.

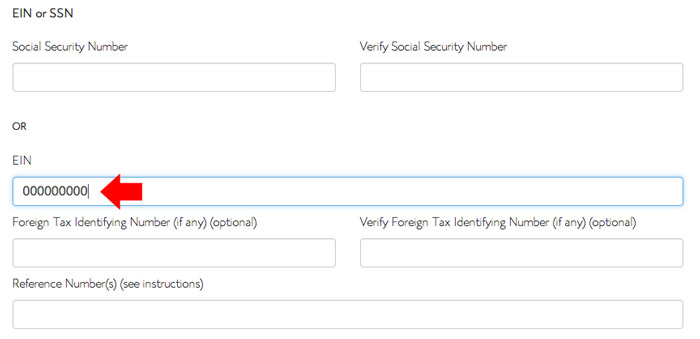

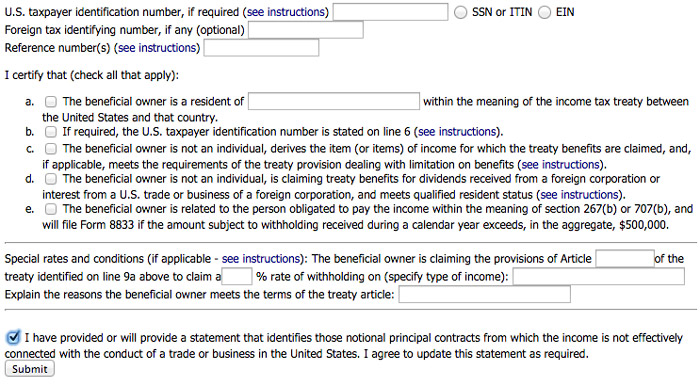

- Next, here is the trick, because you’re not a US citizen or your company outside US, you don’t have EIN / SSN numbers. All you have to do is enter 9 zero’s on EIN space provided and leave the rest blank. See the screenshot below.

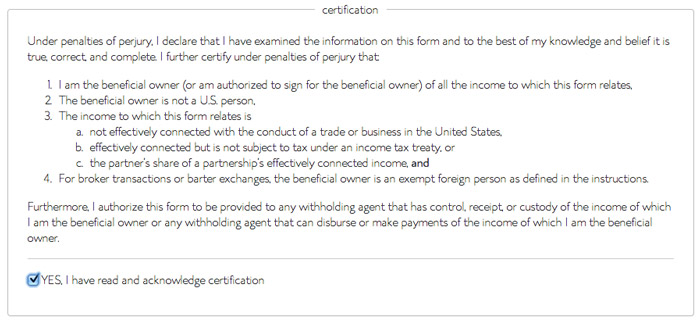

- Scroll down at the bottom of the form and acknowledge the certification by checking the checkbox. Make sure to read first the certification before you check.

- That’s it, your tax form has been submitted to Bluehost, you will wait a day or more to verify your account. They will notify you by email if there’s no problem with your tax form you submitted.

How to fill out Hostgator tax form W8-BEN if you’re non US resident or companies

As I mention above, Hostgator tax form is easy to fill out because you can just leave some of the fields blank without any error. See the screenshot of the form below for your reference.

- Enter the Identification of Beneficial owner, then select the type of the beneficial owner.

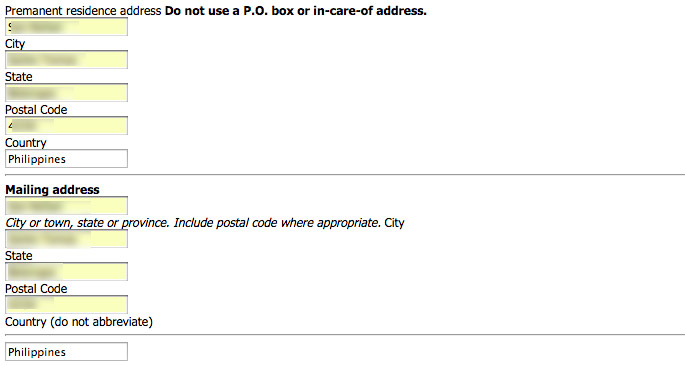

- Fill out permanent residence and mailing address completely.

- After entering your addresses, scroll down and check the checkbox to certify all your inputs and agree to the updates of the statement as required.

- That’s it you can now withdraw your Hostgator earning.

Disclaimer: The above tips are based on my experience, I am not a legal expert. You can always consult a legal expert to better explain all of the contents of the form.

Disclosure: Some of the links in the post above are “affiliate links.” This means if you click on the link and purchase the item, I will receive an affiliate commission without any additional charge from you.